What is Seed Investment?

Startups are projects that aim to provide solutions to specific problems and achieve rapid development in a short period of time. With the development of startups within the problem and solution concept, they easily reach a wide audience and attract the attention of investors. The aim of startup investments, which are realized through certain processes, is to develop and improve dynamics such as team, technology, and marketing. The stages of startup investments that start with pre-seed and continue with seed investment are as follows:

- Pre-seed investment,

- Seed investment,

- Series A investment,

- Series B investment,

- Series C investment.

What is the "Seed Stage" in Startup Investments?

“What is the seed stage?” and “What are the seed stage processes?” are among the most curious questions for new startup founders. Seed stage processes are discussed together with pre-seed and seed investments.

What is Pre-Seed Investment?

Pre-seed investment is the first and earliest stage, and investments usually come from the founder and their surroundings at this stage. However, some angel investors may also make pre-seed investments in projects they see potential in. During the period called pre-seed, the project idea is tried to be realized with a small working group.

The First Official Money: Seed Investment

Seed investment, which symbolizes the first official money collected as a result of your project, is a very important stage for startups. Seed investment is a fragment of future large investments, and it is possible to predict the project's future existence thanks to seed investment. The following channels are recommended for the use of seed investment:

- Improve the product even more,

- Conduct competition analysis,

- Conduct target audience analysis,

- Speed up promotion activities,

- Expand the working group.

Investor Types for Startups

Individuals who invest in startups differ according to the stage they join the project and the budget ratios they provide for the project, and some investor categories emerge. The first among these are angel investors and venture capital investors, both of which aim to make a profit.

Invested startups work to be in larger markets and target wider audiences, and they also make strategic planning in addition to the budget allocated to the project. Some investors also provide mentorship support by contributing to this planning with their previous experiences.

What is an Angel Investor?

Individual investors who allocate smaller amounts of budget to startups are called angel investors. It is possible to encounter angel investors, also known as seed investors, frequently during the seed investment period, but these investors, with the advantage of being individual, can also make pre-seed investments in ventures that have potential.

What are Venture Capital Investors?

Venture capital investors, also known as venture capitalists, allocate larger amounts of budget compared to angel investors and represent professional institutions. These institutions invest in startups, but do not show interest in projects during the seed investment stage.

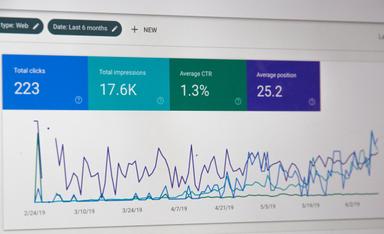

Venture capitalists make larger-scale investments and aim to invest in projects after seeing concrete data and progress. If the project has managed to hold a certain audience and reach a certain stage, venture capital investors become interested in the project.

How to Get Seed Investment?

There are certain points that investors pay attention to in order to invest in startups. These include the project's potential for future success, its ability to solve a global problem, and its ability to appeal to a wide audience.

Investors generally look at the following factors when making a seed investment:

- Short, medium, and long-term goals,

- The impact of the product or service type on society and the world,

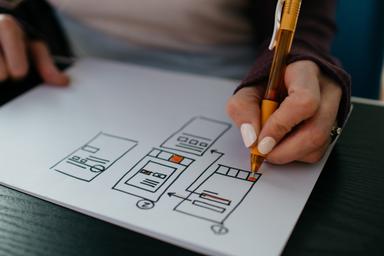

- The product or service prototype,

- Market research and competition analysis.

Tips for Getting Seed Investment

You should develop a strategic plan to achieve long-term success by considering every detail of your idea. While developing these plans, it is recommended that you have a very good understanding of the market you are in and use its advantages in the most accurate way possible. You should also be aware of the disadvantages of the market you are in. This way, you can minimize the threats that await you in the long run. At the same time, through this research, you can maximize the opportunities that will arise in the long term. You should explain all of these dynamics to your investors and communicate with them in a very transparent manner.

The more you can convey to your investors that you are knowledgeable about the subject and have done all the necessary analyses, the more successful your seed investment process will be. Explaining your business idea to more investors and expanding your investor portfolio will also be another move in your favor during the seed investment process. You can join the Startupfon ecosystem to meet investors who are suitable for your business idea.