Co-Investment 101: Co-Investment Guide

The world of investing is full of many different strategies and methods. Investors are constantly looking for new approaches to capitalize on opportunities that offer high return potential. The co-invest or co-investment model, which has become more popular in recent years, allows more than one investor to combine their capital and make a joint investment in the same project. This week on Startupfon-Blog, we have reviewed the co-investment strategy, its advantages and the elements to be considered for you.

What is Co-Investment?

Co-investment or co-investment is an investment model and strategy used in finance and investing, where multiple investors pool their resources to invest in the same opportunity, sharing risks and returns.

The co-invest model allows investors to come together to make larger investments and diversify their risks. One of the main benefits of the co-invest model is that it offers investors the opportunity to make large-scale investments that they cannot do alone. Co-investors can pool their resources and invest in larger deals, which can yield higher returns. In the co-invest model, investors can also benefit from the expertise and knowledge of their partners, which can help reduce risk and improve investment results.

Co-Investment advantages?

The co-invest model offers many advantages such as risk distribution among investors, greater investment opportunities, knowledge and experience sharing, and efficient use of capital and resources.

- More resources: Because co-investment forms a larger part of an investment, investors can invest in larger projects. This is important for investors who want to get more resources.

- Sharing risk: Co-investment allows investors to share risk. Multiple investors can come together to spread the risk and reduce their losses if their investments fail.

- A wider field of expertise: Co-investment allows investors specialized in different fields to come together and invest. This allows investors in different sectors to access each other's areas of expertise, thus helping to build a broader investment portfolio.

- Collaboration and synergy: Co-investment creates cooperation and synergy among investors. Investors can discover and capitalize on new opportunities by interacting and working together with each other.

- Reduction in investment costs: Co-investment can reduce investment costs. By sharing all the costs of the investment, investors can discover that the investment can be made more efficiently and thus costs can be reduced.

With the co-invest model, investors can reduce their risks, obtain more resources, create a wider investment portfolio and invest at lower costs while investing in larger projects. Therefore, co-investment is an effective method for investors to invest in different opportunities.

Factors to Consider When Making Co-Investment

Despite the many benefits of co-investment, it also has some potential elements to consider. First, the co-investment model requires a high degree of trust and transparency among partners, as well as a shared investment philosophy and tolerance for risk. Lack of cooperation and communication between partners can negatively affect investment performance and dispute resolution can be challenging. Working together with partners with different investment objectives may cause difficulties in determining co-investment strategies and objectives. Therefore, it is important that partners have a good understanding of each other's investment objectives and strategies. Additionally, co-investment can be complex and time-consuming, as partners must work together to manage and make the investment. Overall, co-investment can be a powerful tool for investors looking to diversify their portfolios and access greater investment opportunities. As a result, it is important to carefully consider the potential risks and seek support from the right institutions before deciding to become a co-investor.

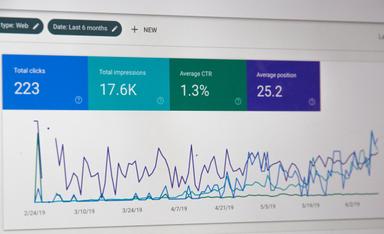

Platforms to be examined for Co-Investment?

There are various co-investment platforms worldwide that investors can use. For instance, some investors may choose to partner with private equity and venture capital funds, which can provide access to a wider range of investment opportunities and support in managing the investment. If you want to take advantage of opportunities to invest in technology startups and be a co-investor in the world of investment, you can become a member of the Startupfon Co-Invest platform.